Glen Luke Flanagan is actually a deputy publisher within Chance Advises just who concentrates on home loan and you may credit card posts. His earlier in the day positions tend to be deputy publisher positions within U . s . Now Strategy and you can Forbes Mentor, and additionally elderly journalist in the LendingTree-most of the concerned about mastercard perks, fico scores, and you will associated subjects.

Benjamin Curry ‘s the manager out-of articles within Luck Advises. With well over 20 years of news media experience, Ben have generally protected financial areas and personal finance. In earlier times, he was a senior editor on Forbes. In advance loans Kennedy of you to definitely, the guy worked for Investopedia, Bankrate, and LendingTree.

The modern mediocre interest to possess a fixed-rate, 30-year conforming mortgage in the united states is six.107%, with respect to the latest investigation supplied by mortgage technology and study team Optimal Bluish. Read on observe average pricing for several type of mortgages and just how the present day pricing compare to the very last said date earlier.

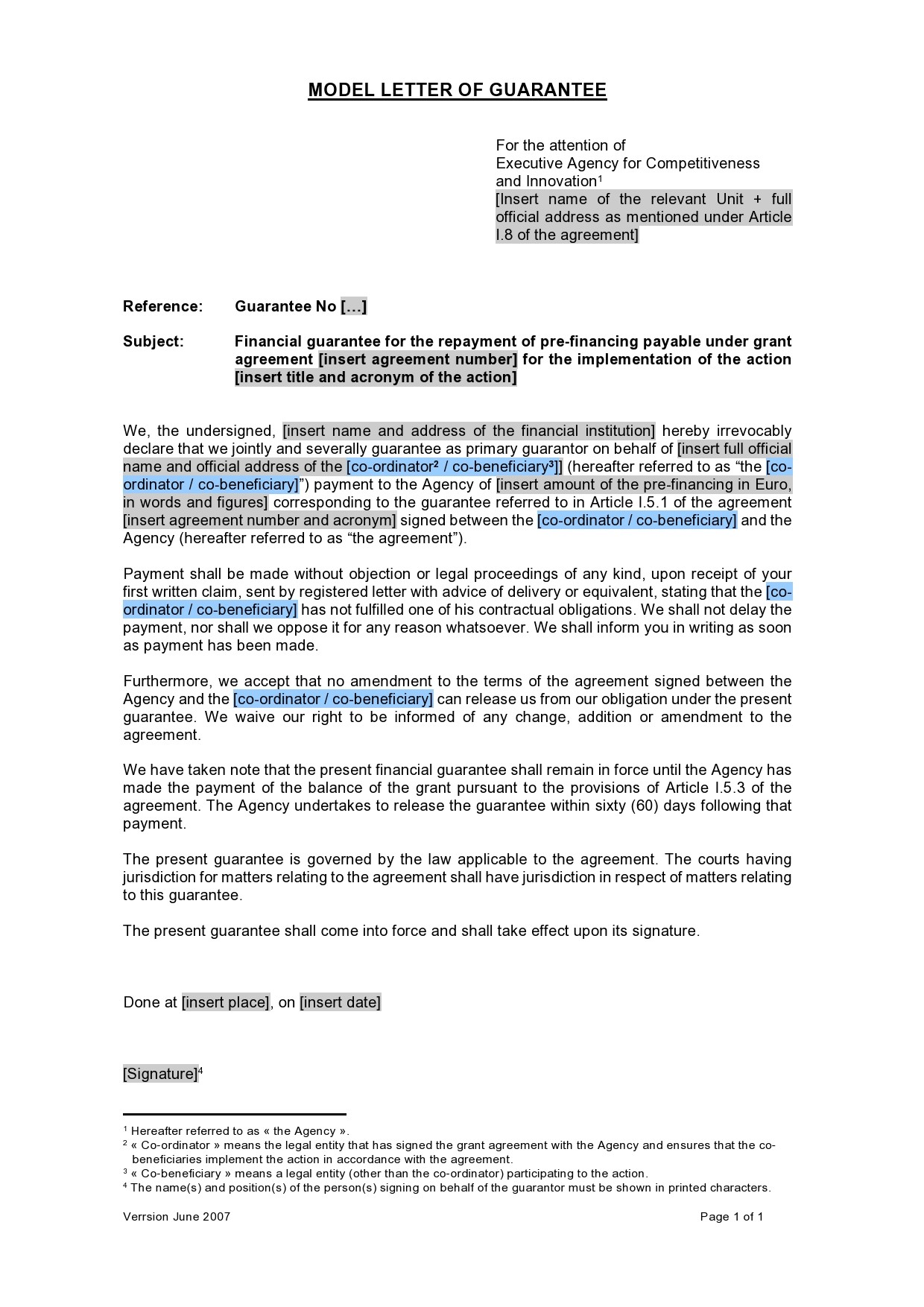

Historic financial pricing graph

Notice, there’s a lag of one business day in the studies reporting, meaning that the most up to date speed to date is what the fresh chart shows having Sep 23.

30-12 months conforming

An average rate of interest, per many current research available during that composing, is 6.107%. That’s upwards of 6.062% the final claimed go out earlier in the day.

30-seasons jumbo

What is actually an effective jumbo home loan otherwise jumbo financing? Put simply, it exceeds the absolute most to own a consistent (conforming) home loan. Fannie mae, Freddie Mac, plus the Federal Houses Financing Service set this maximum.

The common jumbo financial rates, for every single the most newest research readily available as of this writing, is 6.492%. Which is up of six.347% the final stated big date past.

30-year FHA

The new Government Casing Management will bring mortgage insurance rates to certain loan providers, and the loan providers in turn could offer the user a better price towards the elements particularly having the ability to be eligible for a good mortgage, possibly and make an inferior deposit, and possibly providing a diminished speed.

An average FHA mortgage price, for each and every probably the most newest investigation readily available at the writing, was 5.900%. Which is up out of 5.825% the past advertised time early in the day.

30-seasons Va

An excellent Virtual assistant financial is out there of the a personal bank, nevertheless the Department regarding Pros Issues promises part of they (reducing chance toward lender). He is accessible when you’re a beneficial U.S. army servicemember, a seasoned, otherwise a qualified enduring lover. Like finance may often allow the purchase of a home which have zero downpayment whatsoever.

The common Virtual assistant financial rates, for every single one particular latest research offered only at that writing, is 5.522%. Which is up out of 5.487% the past stated day past.

30-12 months USDA

This new You.S. Department away from Agriculture works apps to greatly help lowest-earnings individuals achieve homeownership. Such as for example funds may help U.S. citizens and you can eligible noncitizens get property with no down payment. Remember that you can find stringent criteria being qualify to have good USDA mortgage, such as for example earnings limits additionally the house in an eligible outlying town.

The average USDA home loan speed, for each and every the essential most recent research readily available at this writing, is actually 6.024%. Which is upwards from 5.850% the very last reported big date early in the day.

15-year mortgage cost

A fifteen-seasons home loan usually generally speaking mean higher monthly installments but faster attention reduced along side life of the loan. The common speed getting a beneficial 15-seasons compliant financial, each the absolute most newest data readily available at the creating, is actually 5.273%. That’s right up out of 5.177% the last stated go out early in the day.

Why do financial pricing vary?

If you find yourself your own personal credit profile rather has an effect on the borrowed funds rate you are given, various outside situations plus play a part. Secret has an effect on tend to be:

Comentarios recientes