The new disadvantage to this type of preparations would be the fact both you and the supplier typically have entry to less judge defenses than with conventional funds. You need to work at an attorney to greatly help write the brand new documentation.

eight. Local financial

You happen to be capable of getting a home loan of a financial throughout the foreign country the place you are interested possessions. To achieve this, you will probably need certainly to provide:

- Proof of term

- Evidence of income

- Recent tax account

You should also understand the exchange rate effect out of people forex trading mortgage loans: If the property value the brand new fx rises in accordance with the U.S. money, you could end up using more expected.

Step one when you look at the buying property to another country is actually guaranteeing one you can. Specific places restriction who can own property. Such, people from other countries who would like to purchase property in the Austria should be commercially acknowledged ahead of time. For the Mexico, people from other countries fundamentally usually do not pick assets in a few restricted zones. And in Spain, each one of the 17 places possesses its own regulators and guidelines, which can complicate matters.

How you can know how to buy a property inside a different country would be to work on a representative who may have used to the room and you can worldwide sales. Are linking with other expat people and you may correspond with them in the just who it worked with. You may must get a district home attorney to make sure that you don’t work at afoul of every international guidelines.

Without a doubt, don’t neglect to definitely for instance the city in advance! To find property in another country is a huge decision you to must not be drawn lightly. Does your following home have the version of environment and points you enjoy? Is there a thriving expat neighborhood you might apply to? What about accessibility medical care? All these inquiries and much more will likely be expected before buying property to another country.

As well as ensuring the location you’re to get when you look at the is an effective great fit to you, there are many essential issues to inquire about before you buy around the globe assets.

Have a tendency to the house or property getting hard to care for?

Domestic repairs try an option planning having any assets purchase – but particularly when to invest in overseas because you iliar which have regional resolve choices. The fresh weather and you can age of our home is also greatly change the likelihood of needing fixes, but you must consider what all round upkeep can look particularly. An effective vineyard on southern from France will need greatly different repair than simply a beneficial condominium during the Paris.

Have there been cover inquiries?

Another essential consideration is defense. This can be correct even if to get property locally, but it’s an even bigger question before buying overseas. Do you know the crime prices such as your chosen town? Will be the bodies known to be attentive to needs help? payday loans Nebraska Make sure to cause for the cost of property protection program when you decide one is needed.

Do i need to book the property?

If you are planning to help you rent your international possessions or imagine you may prefer to later on, you’ll want to check the local quick-identity local rental guidelines. You could get a property owner in your community also. Select fees, once the you’ll be earning money overseas. You are able to be eligible for the latest Irs foreign made income difference, the newest international housing difference and/or perhaps the international property deduction for those who meet what’s needed.

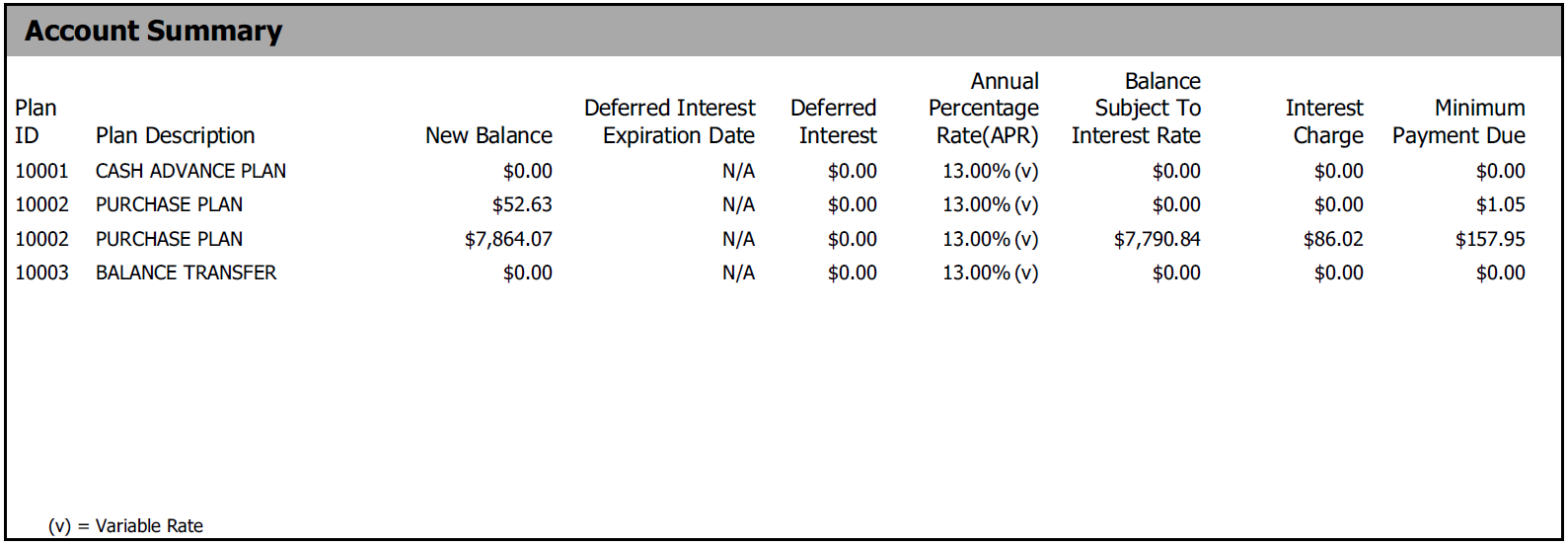

Exactly what fees can i spend?

Think about the tax effects of international possessions get carefully before to acquire. Whilst you need not declaration the home buy toward Internal revenue service, you may need to shell out fees towards the people local rental money otherwise profits from coming conversion. you will need to statement if you unlock a foreign lender membership. Subsequent, in the event the house is respected significantly more than a specific endurance, you can even have to file a different Membership Taxation Conformity Operate (FATCA) report.

Comentarios recientes