For many who individual accommodations assets, you realize it is an effective supply of inactive earnings. But can you utilize it to build greater wealth through getting a property guarantee loan to your accommodations property? Experiencing brand new guarantee from a low-number one household should be a fundamental piece of your financial means. With the right disease and you may advice, you are able to an informed household equity fund to protect your own capital or increase your profits.

Is it possible you score a property equity financing into a rental property?

You can purchase a property security financing with the accommodations property for individuals who meet what’s needed, like that have enough equity regarding possessions and a great credit score. Tapping into the guarantee of money spent might be part out-of a bigger funding and you will wide range-strengthening techniques.

Although not, you’ll have to perform some calculations to see if a house collateral mortgage on your own rental home is how you can accessibility additional loans. You need to be in a position to pay-off the borrowed funds and have now a concrete policy for making use of the share you receive. As the we’re going to select subsequent on, simply because you should buy a property equity mortgage for the an effective local rental possessions cannot instantly mean you will want to.

Factors to consider before applying getting a rental assets household security mortgage

Before committing to a house guarantee mortgage on your own local rental possessions, make sure to see the private facts and you will implications that go on borrowing. You’ll want to make certain that you’re in a position to handle intrinsic costs. Take into account the after the:

The money you owe

Your financial situation have a tendency to determine in the event you can aquire acknowledged and you will even if you can afford to repay your own local rental property house collateral loan. Lenders commonly look at your income and you will credit history. Very lenders require a rating of at least 700.

The debt-to-earnings (DTI) ratio also can apply at what you can do to borrow. That it DTI worthy of reveals the degree of loans you really have opposed with the money. Loan providers have a tendency to want to see a great DTI out of 43% otherwise quicker, as this ways enough room on the funds to look at a different sort of commission.

To repay your house collateral mortgage, you must be ready to generate monthly obligations promptly in inclusion into the financial. House collateral fund are available having closing costs. You need to be equipped to handle these types of a lot more fees above of your own this new payment.

The borrowed funds number that you have to have

The value of the home while the guarantee you’ve put in usually privately determine the newest dollar number of the borrowed funds you might found. You might face a share cover towards full withdrawable security, for example 85%, if you have reduced the house out-of completely currently.

The mortgage-to-well worth (LTV) ratio is additionally an essential build. Your LTV ‘s the analysis of your own requested amount borrowed to this new property’s appraised worth. Some loan providers have limited LTV hats having investment properties, particularly sixty%.

Concurrently, some banks ount available for local rental services, such as for example good $100,000 complete. This type of ount offered to have traditional house security finance, and that’s multiple hundred thousand. Ensure together with your bank what they may offer to possess low-first homes before applying.

Financing small print

Investment property home collateral money normally come within a predetermined rates. They can be provided to possess regards to 5 to 3 decades in length. You are able to find financing and no pre-commission punishment. Although not, the rate tends to be high towards the property collateral loan for a rental assets.

Taxation implications of leasing assets home collateral loans

The attention you only pay in your rental possessions domestic equity mortgage is generally tax deductible, which can only help reduce your nonexempt income. not, so you can qualify for which taxation deduction you must utilize the financing to alter the house. At the same time, you cannot book the home in that income tax seasons, and you also need to designate the property just like the an experienced quarters on the your own tax go back.

Choice financial support offer offered

If you’re looking for option investment offer towards domestic collateral financing, you can even desire to evaluate these other options:

- Home security line of credit (HELOC): A new alternative to tap into your home guarantee is actually a home collateral credit line. When you are a house security financing will provide you with a lump sum borrowed up against your own security, a great HELOC is a credit line you could costs facing up to your own restriction as required. Then you pay it back, exactly like exactly how credit cards work.

- Cash-aside re-finance: A money-away refinance makes you take back a few of the currency you’ve paid to your a home loan and then refinance more matter you now owe. It an easier procedure than property security financing since it pertains to a single fee, while a house security loan needs one to loans in Hudson generate regular loan payments at the top of home loan repayments.

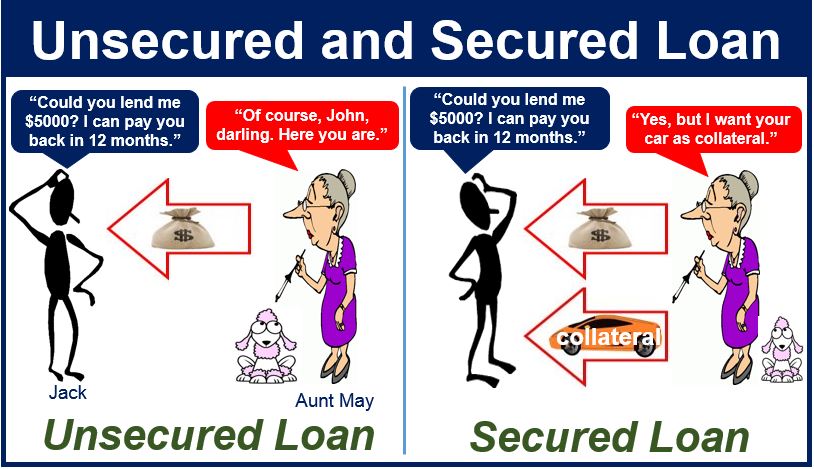

- Unsecured loan: Whether or not rates toward unsecured debt such as for instance an unsecured loan are often greater than cost with the protected debt particularly a good home guarantee mortgage, they can be preferable for those who do not want to lay the money spent vulnerable to prospective foreclosure.

Comentarios recientes