The advantages is fairly simple to your FHA 203(k) financing program and it is obvious as to the reasons more and more people use this high do-it-yourself tool to increase the value of their property. However, just as in all else, you will find disadvantages therefore we try list those also so you’re able to make certain you has actually a far greater insights on the best way to go-ahead.

- Capability of get one mortgage (in place of a few)

- A clearly discussed project plan

- When your project is completed you have got immediate equity regarding house

Disadvantages Of FHA 203(k) Loan System In California:

- The interest prices are .50% to one.00% higher than a routine FHA financing

- FHA finance like the 203(k) system incorporate Financial Insurance coverage (MI).

- You must get a company

- You must are now living in the home for around 12 months ahead of offering otherwise renting our home

Who’s Eligible for Good FHA 203(k) Loan?

Luckily for us that applying for an excellent FHA 203(k) financing will not be given that tough because you thought. One demands is the fact that FHA 203(k) loan is actually for people that are looking to purchase a primary house or if perhaps you may be refinancing you currently live-in the house. It is not to possess funding features, trips homes otherwise property flipping.

The latest FHA 203(k) loan into the Ca has flexible guidelines for recognition; the same as men and women getting a regular FHA mortgage. Most lenders really wants to get a hold of a 620 or maybe more borrowing rating but some will go lower than 620 straight down so you can an effective 580 credit rating. Old-fashioned construction finance generally speaking like to see a credit rating of at least 700 or maybe more and so the 203k is a superb option for somebody who has poor credit.

The debt-To-Money (DTI) ratio should be below 43% but you might possibly wade sometime high and you may you could borrower doing 110% of your own property’s coming value.

The brand new down payment criteria try step 3.5% of the property speed and the total endeavor prices. If you is to buy a property to possess $250,100000 and fixes is $20,000 your lowest downpayment are $9,. And the great is the deposit may come of your or perhaps be provided to your once the a gift.

FHA 203(k) Refinance loan

The main use of the FHA 203(k) financing from inside the Ca is actually for the acquisition and update out of an effective family you could make use of the financing with the property you already are now living in by refinancing your current home loan for the a special FHA 203(k) financing. The loan matter carry out equivalent the mortgage you are settling in addition to fund must resolve and you will improve the house.

An appraisal is done as well as in the brand new report, the latest appraiser will give a recent well worth and you will the next worthy of that is required to obtain the loan acknowledged. Their limitation amount borrowed try 110% of the future value of our home moments %.

Crucial FHA 203(k) Financing FAQ

There is a lot on the FHA 203(k) loan from inside the California and more details should make it easier to most useful see the details of undertaking the fresh rehab mortgage away from FHA. https://cashadvancecompass.com/loans/signature-installment-loans/ When you are ready make sure to work with a loan Manager which is happy to let your ambitions come true. That loan Administrator that’s willing to just render higher terms and conditions however, one who needs the full time to resolve their questions.

Can there be A max Amount borrowed?

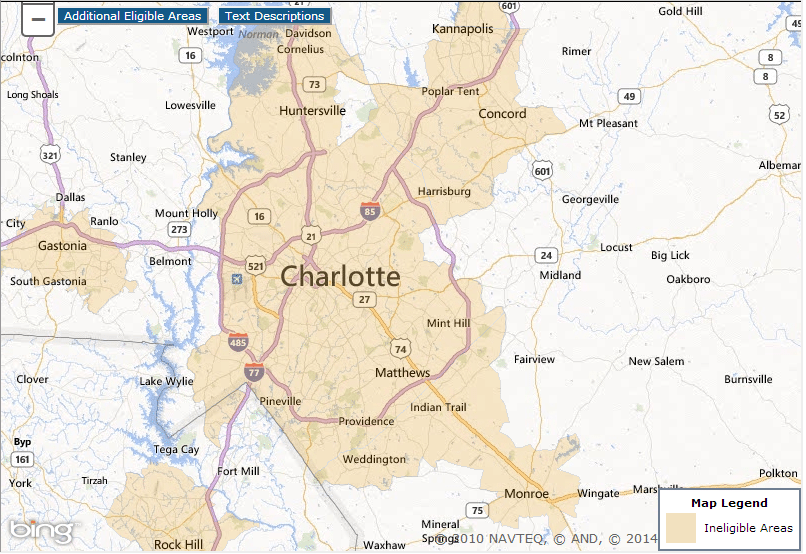

Sure you will find; 110% into the future property value the house as well as the amount borrowed should be at otherwise below the FHA loan maximum for your county.

Comentarios recientes